A quest for the perfect programmatic private deal

Abstract: Are we doing programmatic deals all wrong? An intensive analysis of Programmatic Private Deals has shown that not every deal works equally well in every SSP. The following article will show why this is the case and how this insight can be utilized to have a profitable impact on our and possibly also your deal setup.

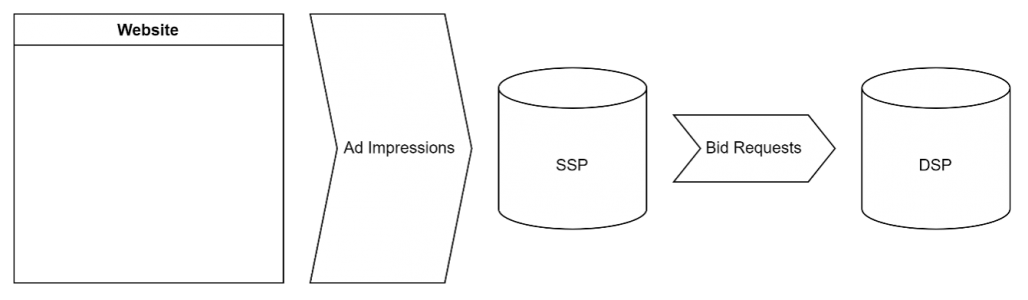

As a general understanding, the perfect programmatic deal looks like the following: A seller creates a deal in a SSP of his choice, defining inventories, formats, target groups and floor prices. Then a deal ID is generated and sent to the buyer. The buyer then usually uses this ID to bid on the seller’s inventory buying impressions through his DSP.

Is the perfect deal really that simple though – one SSP and one DSP?

We could not believe that and took a deeper look. We found out that it is not really that simple.

Private Market Deals vs. Open Auction – what are the differences?

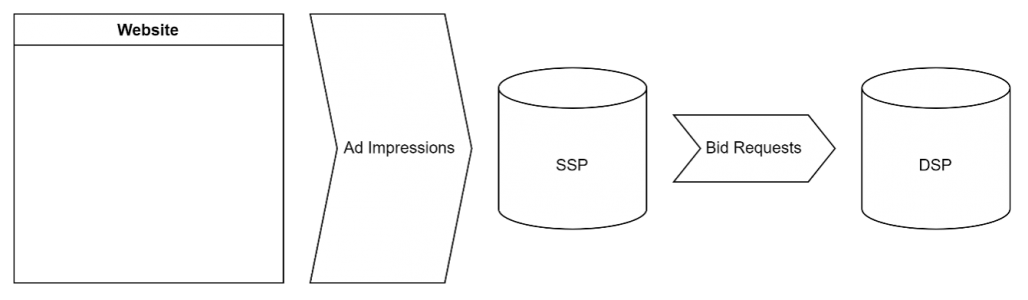

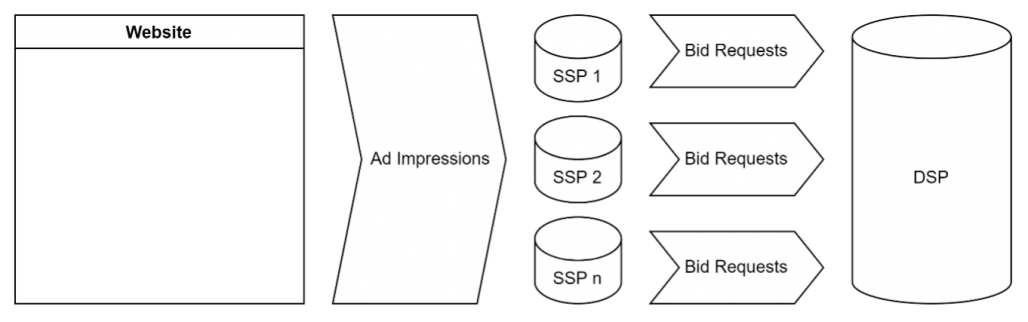

First, let us distinguish Private Deals, aka Private Marketplaces (PMPs), from the Open Auction (OA). With PMPs sellers have a direct connection to their buyers and private deals are being set up through a 1:1 connection between precisely one SSP and one DSP (see Figure 1). Further, tech fees for buyers and sellers are generally lower for PMPs, and marketers/publishers bear the so-called “deal fee” themselves. With OA though, the tech fee is deducted from the buyers’ budgets with their demand paths.

Inevitably the question is as to why still a huge share of money is spent in OA anyways? The answers are manifold but simple: OAs are associated with less effort, and they are added as buying channels because advertisers and agencies cannot spend their budgets through deals alone.

Furthermore, purchasing in OAs takes place by default across all connected SSPs, unless certain SSPs have been disabled on purpose. Latter is rather rarely the case. Thus, a de facto 1:n connections between DSPs and SSPs automatically exist in the OA.

Figure 1: Single-SSP setup — 1:1 relationship between DSP and SSP

Due to bid throttling and potentially non-complete cookie-matching, the SSP does not send every available ad impression as a bid request to the DSP. This means that a subset of ad impressions is filtered out and is not available to the DSP.

Can or even should this 1:n relationship model also be applied to PMPs?

Sellers and SSPs provide bid requests buyers and their DSPs. From our initial hypothetical stance this would not work equally well in all SSP-DSP constellations. For validation purposes, we performed an empirical analysis.

Based on our long-term relationships with buyers, we were able to recruit media agency traders for structured experiments. Again, we would like to thank our colleagues for their participation.

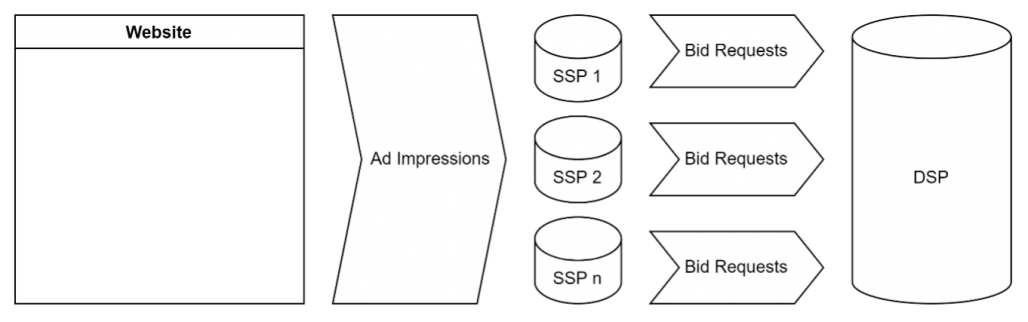

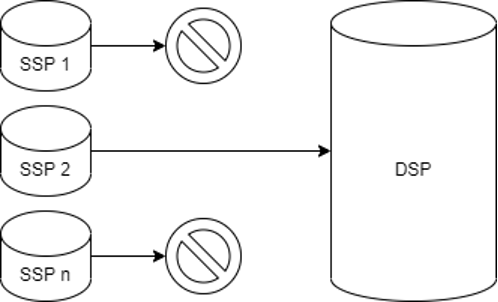

The test design was as follows: deals with exactly the same configurations were set up in one of the buyer’s DSPs and sent to multiple seller’s SSPs (see Figure 2)

Not all deals performed equally well!

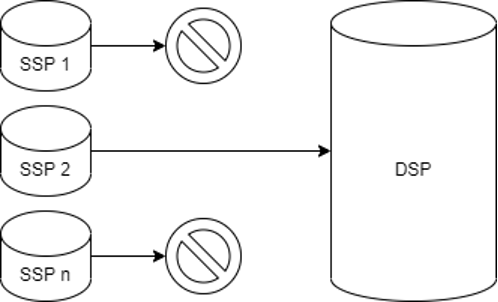

The amount of bid requests sent, varied from SSP to SSP, sometimes by up to 40%, though deal configurations were completely identical. Thus, the so-called bid throttling seems also to appear on the SSP side and not only the DSP side. Latter has become generally known market practice, and it makes sense from a technical as well as economical point of view. Especially in times of extensive use of header bidding, technical infrastructure costs have mounted with increasing queries per second (QPS). A DSP sometimes receives the exact same impression several times though multiple SSPs. Therefore, for DSPs it makes sense to aim their bids only towards requests with potentially highest win rates.

After consulting with SSPs participating in our tests, it turned out that most of them implemented different types SSP-side bid throttling layers. For example, the SSP with the fiercest bid throttling generated the highest deal revenues. Apparently, DSPs reward the quality of incoming bid requests (e. g. win rates, viewability).

Fewer bid requests are not necessarily better though since this does not provide buyers with full access to sellers’ overall inventory and associated users. It is possible and even probable that one specific SSP does not pass a bid request for a certain impression due to its own bid throttling layer, but the buyer would actually want to buy precisely that impression. At this point, in multi-SSP setups, one of the other SSPs now “steps in”, sends the bid request and thus allows the buyer to get access to the inventory. In our test, this circumstance was reflected by the fact that revenue was generated in all deals in the setup. At the same time, the clearing price was very close in all of them, so that the buyer does not have to worry about outbidding himself.

Figure 2: Multi-SSP approach — 1:n relationship between DSP and SSP(s)

All possible ad impressions are available to all SSPs. Due to bid throttling and potentially incomplete cookie-matching not every SSP sends every possible ad impression as a bid request to the DSP.

However, since the DSP is requested by several SSPs, the probability that an ad impression is requested to the DSP is significantly higher.

So what does the perfect deal eventually look like?

We conclude that the one perfect programmatic private deal does not exist! It rather makes sense to mirror the same deals into multiple SSPs (see Figure 2). This is the only way for the buyer to get the best access to the inventory or user and for the seller to monetize them in the best possible way via deals. It should be noted, however, that the setup complexity increases with an increasing number of deals. This primarily affects operational layers like deal setup, monitoring and debugging. However, for buyers this additional effort can be mitigated quite easily if SSPs would seamlessly be integrated into DSPs and/or vice versa. Then the seller would simply push created deals into DSPs, which on their side only would need to accept them. Some SSP-DSP constellations already offer this feature and those that do not are invited to consider implementing it.

At the same time sellers might consider developing API driven Meta-SSP deal tools where a respective deal is created once and then transferred to all relevant SSPs automatically. At Axel Springer / Media Impact we were able to implement a Meta-SSP deal management interface that supports the operationalization of tactical insights resulting from experiments like the one presented in this paper. At this point we again invite all reputable SSPs / DSPs to provide and continuously extend their corresponding programming interfaces.

Summing up, transparency in general and with regard to bid throttling has one of the highest priorities for us. A simple and “there is an AI-supported algorithm” does not adequately clarify the issue, and the entire industry still has some work to do here and the field of demand / supply path transparency. In the meanwhile, we invite all buyer to deep dive with us into our mutual setup to find out the perfect programmatic private deal together.